Indonesia’s banking industry has undergone a profound transformation over the past few decades. What once relied heavily on in-person interactions with tellers at branch offices has now shifted to digital-first services. Today, customers can transfer funds, pay bills, invest, or even apply for loans directly from their smartphones. This major shift would not be possible without data centers, the core infrastructure enabling modern financial services.

A recent episode of the Nusantara Data Center Academy podcast highlighted this topic in detail. Hosted by Oktaviani, the discussion featured two industry veterans: Hermawan Tendean, Commissioner of i4t and former Senior Executive President of IT at Bank BCA, and Billy Guan, Vice President of IT Service Operation at Bank Permata. Together, they unpacked the evolution of data centers in Indonesian banking, the regulatory landscape, strategic decision-making, and the future of banking technology.

From Small Rooms to Nationwide Infrastructure

In the late 1980s, Indonesian banks began transitioning from manual systems to computer-based operations. At that time, data centers were nothing more than small rooms equipped with basic cooling and a handful of servers, used primarily for internal processes such as customer transaction recording and account management.

Over the years, however, as digital banking services grew, the demand for larger capacity and higher reliability became unavoidable. Leading banks now operate multi-data center architectures, often in an active-active configuration, where one data center can seamlessly take over if another experiences disruption. This ensures high availability, providing uninterrupted digital banking services and meeting customer expectations for 24/7 reliability.

This evolution represents more than just technological advancement—it reflects the growing need for speed, convenience, and trust in the financial sector.

Operational Stability, Security, and Regulatory Compliance

For banks, data centers are not just technical facilities; they are the operational heart of the institution. Even the smallest disruption can affect millions of customers.

Experts highlight three critical pillars:

- Operational stability – Modern data centers must feature redundant infrastructure, fire protection systems, and reliable backup power to ensure zero downtime.

- Data security – Both physical security (restricted access, 24/7 monitoring) and cybersecurity are essential to protect against internal breaches and external attacks.

- Regulatory compliance – Indonesian regulators mandate strict oversight, requiring banks to report data center details annually, enforce data lifecycle management (including secure disposal), and maintain privacy safeguards for customer information.

In this context, innovation in banking IT must always be balanced with compliance and protection, ensuring that customer trust remains uncompromised.

Geographic Concentration and Its Risks

Due to infrastructure realities, most banking data centers in Indonesia are concentrated in Jakarta and Bali, where stable electricity, telecommunications, and logistics are more readily available.

While this concentration is practical, it also introduces major risks:

- Disaster vulnerability – Jakarta is prone to flooding and earthquakes. A large-scale disruption could have nationwide financial impacts.

- Unequal data distribution – With Indonesia’s vast geography, a Jakarta-centric model creates challenges in ensuring accessibility and resiliency for customers across the archipelago.

Geographic diversification of data centers, including in Sumatra and Sulawesi, will be essential to reduce systemic risk and strengthen resilience at the national level.

Build or Colocate? A Strategic Dilemma

One of the most significant decisions banks must make is whether to build their own data centers or use third-party colocation services.

- Building in-house allows banks full control, greater flexibility, and stronger security. However, it demands significant capital investment and operational expertise.

- Colocation offers lower upfront costs and faster deployment, but it may limit operational agility and raise concerns about data security.

The choice is not purely financial; it reflects a bank’s long-term vision for technology adoption, risk management, and customer service.

Sustainability and Energy Efficiency

Data centers are among the most energy-intensive infrastructures globally, making sustainability a rising priority in banking operations.

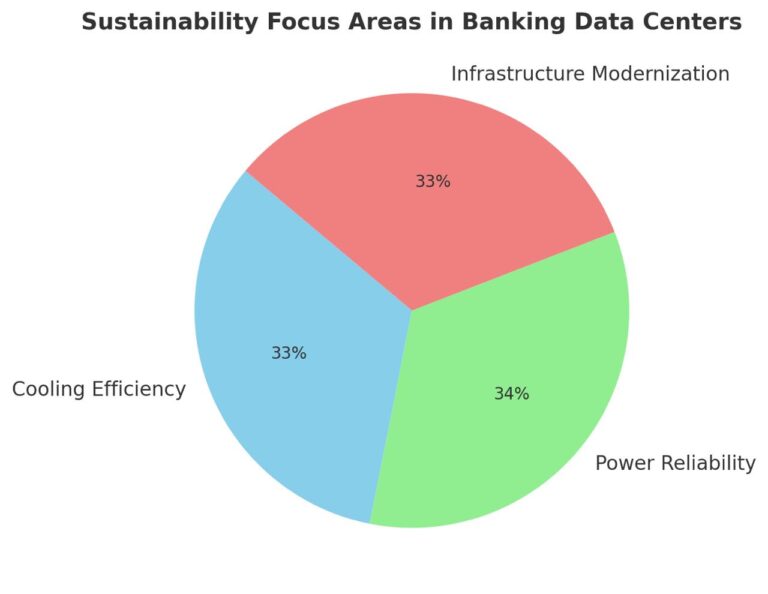

Indonesian banks are taking steps to address this challenge through:

- Cooling optimization to reduce excessive power consumption.

- Collaboration with PLN, the state electricity provider, to ensure reliable and high-quality power supply.

- Regular infrastructure upgrades to modern, energy-efficient systems that align with global carbon-reduction targets.

Sustainability efforts serve not only to manage operational costs but also to position banks as responsible contributors to environmental goals.

Disaster Preparedness and Business Continuity

As a disaster-prone nation, Indonesia faces risks such as earthquakes, tsunamis, and volcanic eruptions. For banks, this makes business continuity planning and disaster recovery strategies non-negotiable.

- Redundant systems and geographically diverse facilities must be in place to guarantee uninterrupted services.

- Regulators require banks to conduct regular stress tests and scenario drills to ensure preparedness during emergencies.

These measures highlight the strategic importance of resilience, as banking operations are directly tied to national economic stability.

Emerging Trends Shaping the Future

Looking forward, Indonesian banks are beginning to embrace new technological models for their data centers, including:

- Cloud integration for greater scalability and agility.

- Automation to improve operational efficiency and reduce human error.

- Hybrid data center models, combining physical infrastructure with cloud-based solutions.

- Advanced cybersecurity systems to defend against increasingly sophisticated threats.

These innovations will help banks remain competitive, enhance customer experience, and align with both regulatory and market demands.

Conclusion: Data Centers as the Foundation of Banking’s Digital Era

The journey of data centers in Indonesia’s banking sector mirrors the nation’s broader digital transformation. From modest computer rooms with limited functions, they have grown into highly sophisticated, secure, and resilient infrastructures that keep the country’s financial system running 24/7.

The road ahead will require banks to balance innovation with compliance, centralization with diversification, and efficiency with sustainability. By investing in robust disaster recovery, embracing emerging technologies, and strengthening operational security, Indonesian banks can ensure they remain resilient in the face of technological, environmental, and geopolitical challenges.

As emphasized in the Nusantara Data Center Academy podcast, the future of banking will be defined not only by digital services but also by the strength, adaptability, and resilience of the data centers that power them.

For more details, listen directly to the podcast on YouTube Nusantara Academy and don’t forget to register for training by contacting https://wa.me/6285176950083